How Individual Tax Rates Work

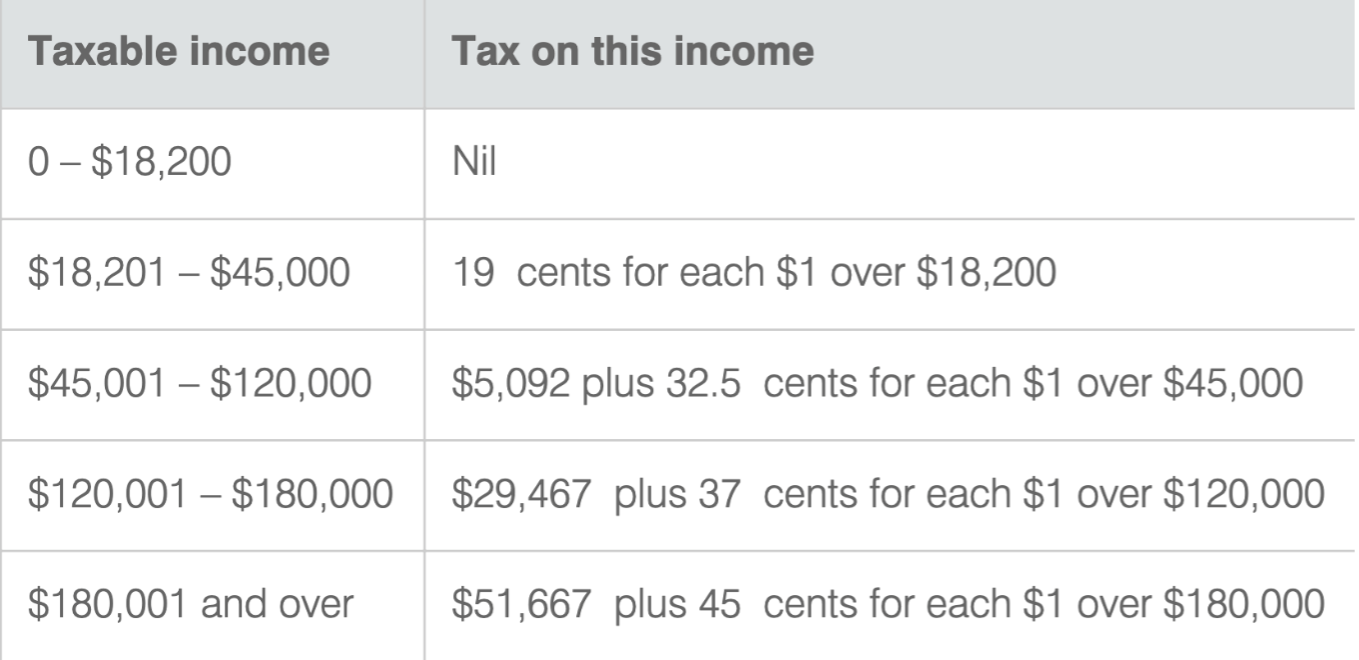

Rates from June 2021 – June 2022

*The above rates do not include the Medicare levy of 2%

Medicare levy threshold and rates

Your Medicare levy is reduced if your taxable income is below a certain threshold; in some cases, you may not have to pay the levy at all. As of the 2021 income year, the Medicare levy low-income threshold is increasing for singles, families, seniors, and pensioners.

- Singles — from $22,801 to $23,226.

- Families — from $38,474 to $39,167. For each dependent child or student, the family threshold will be increased by an additional $3,597 (previously $3,533).

- Single seniors and pensioners — from $36,056 to $36,705.

- Family seniors and pensioners — from $50,191 to $51,094.

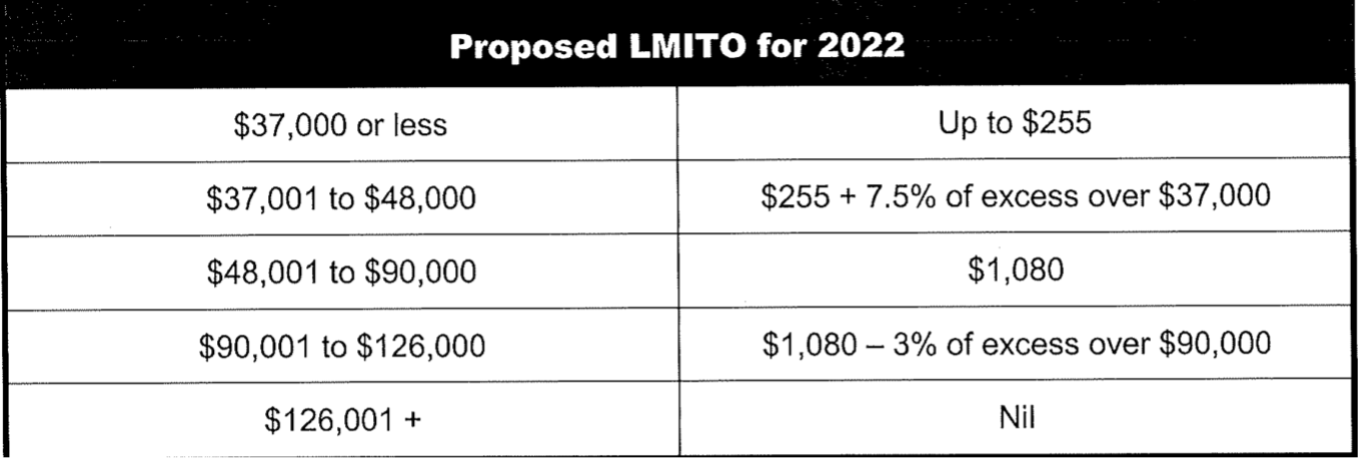

Retaining the low and middle income offset

A tax offset is a financial benefit from the Government that reduces the amount of tax you pay on your taxable income. Although it was due to be removed from July 1 this year, the Government will be retaining the low and middle income tax offset (LMITO) for one more income year, making it available for the 2022 income year.

You don't need to complete separate form or section in your tax return to get this tax offset — the ATO works out the amounts on your behalf when you lodge your tax return (if you’re eligible). As always, in order to benefit from this offset you need to be an Australian resident for income tax purposes, pay tax on your taxable income, and that income needs to be below certain income thresholds.

Talk to us

Our team of tax experts are ready to strip back the complications what come with tax returns and help you complete yours, stress-free. From submitting your 2020 – 2021 tax to strategic tax planning for the next financial year (and plenty of other accounting services), we can help.

Need help with your accounting?