Instant asset write-off

Your eligibility

Eligibility for the Instant Asset Write Off on an asset depends of these certain things:

- Your aggregated turnover (the total ordinary income of your business and that for any associated businesses)

- The date on which you purchased the asset

- When the asset was first installed ready for use, or actually used

- The cost of the asset being less than the current or relevant threshold

You are not eligible for the instant asset write off on an asset if your aggregated turnover is more than $500,000,000. And if the temporary full expensing applies to a particular asset, you do not need to apply the instant asset write off.

Thresholds

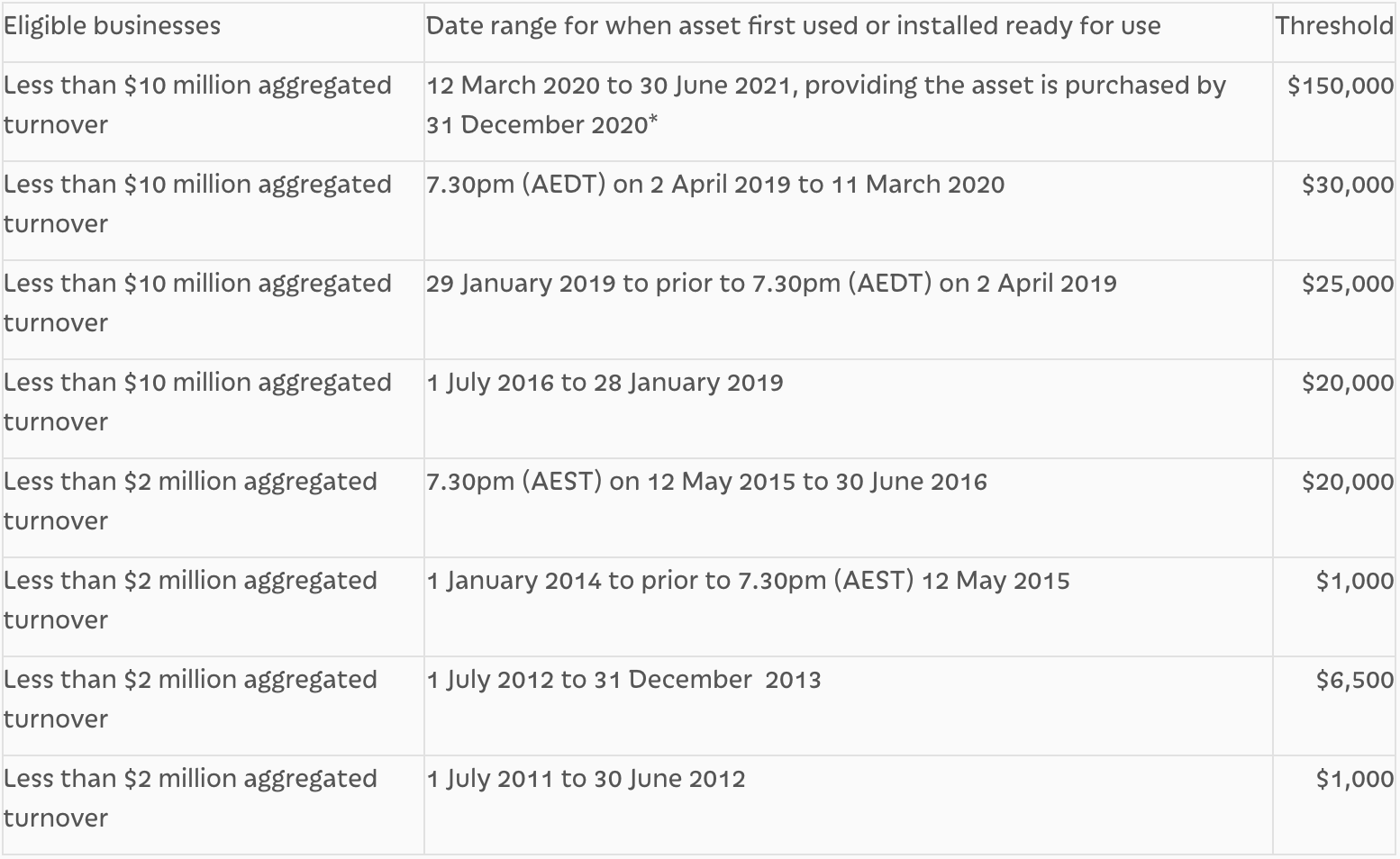

The thresholds have changed over the years so it is important to reference the most up to date information to see what applies and does not apply.

Instant asset write off thresholds for small businesses that apply the simplified depreciation rules are as follows: (*sourced from www.ato.gov.au):

* You must have purchased the asset on or after 7.30pm (AEST) on 12 May 2015.

There are also several exclusions and limitations to the instant asset write off. These include, but are not limited to, car limits applied to the cost of passenger vehicles and a small list of other assets including things that will be expected to be leased out for more than 50% of the time and capital works.

What next?

Before deciding to make any large purchases for your small business, chatting to your tax agent or accountant will help a lot. Especially when it comes to assessing how an asset will benefit your business and how the purchase could impact your cash flow or finances in the short term.

If you do decide to take advantage of the instant asset write off, you should make this decision based on the needs of your business and that align with your business plans and goals.

Need help with your accounting?