Urgent Action Required: Director ID Numbers

In Australia, you need a Director Identification Number (DIN) if you're a director of a company, registered Australian body, registered foreign company or Aboriginal and Torres Strait Islander corporation. Previously, you could set up your DIN when you had already set up your businesses, but now, this must be done before you set up a company.

So, why the urgency? It wasn’t a clickbait title: existing Directors must have a Director's ID number before 30th November, otherwise, they will be fined by ASIC.

This can be quite a confusing process, so we’ve laid out the steps you need to take below.

- Go to Australia Business Registry Services and ensure you understand what the Director Identification Number (DIN) is, who needs to apply for it and how to apply.

- On the same ABRS website, click the “Apply now” button.

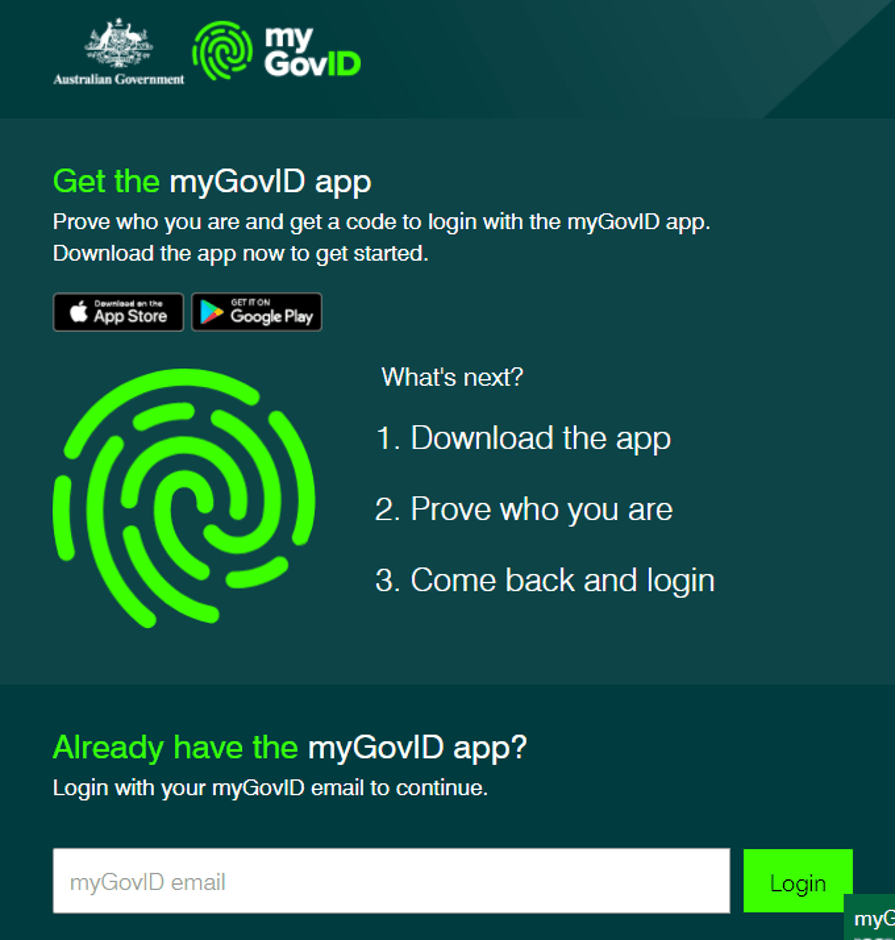

3. If you haven’t already done so, set up your myGovID. This is an app you can download for free to your smartphone — it is not the same as myGov. This step needs to be completed before you can apply for the DIN. Instructions on how to set up myGovID can be found here.

4.Gather your required proof of identity documents. You will need:

a. your tax file number (TFN)

b. your residential address as held by the ATO

c. information from two documents to verify your identity, including:

i. bank account details — Ascent recommends this form of ID.

ii. an ATO notice of assessment — Ascent recommends this form of ID.

iii. super account details

iv. a dividend statement

v. a Centrelink payment summary

vi. PAYG payment summary.

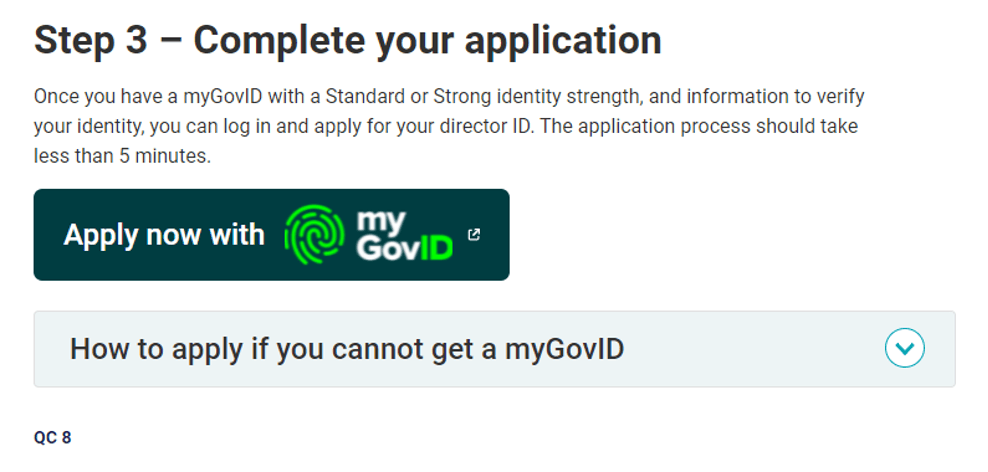

5. Under “Step 3” click on the “Apply now with myGovID” button.

6. If you are not able to apply for a myGovID, you can verify your identity by calling the Australian Taxation Office (13 62 50) or lodging a paper form (we can provide you with a copy of the form). We recommend trying to apply using the online option as this is the fastest and easiest way to apply.

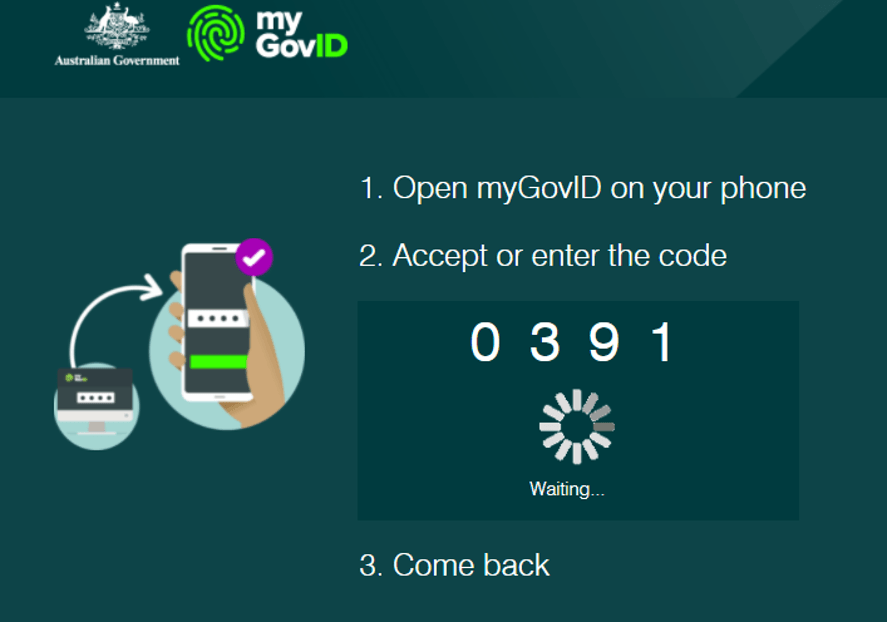

7. After selecting “Apply now with myGovID”, you’ll be taken to the myGovID login page. On this page, insert your myGovID email in the box at the bottom of the page. Select “Login”, and a four-digit number will appear on the page.

8. On your smartphone, open the myGovID app and log in with your password. A white screen will then appear in the app asking for the four-digit code from the webpage in step 7 above. Enter this and select login.

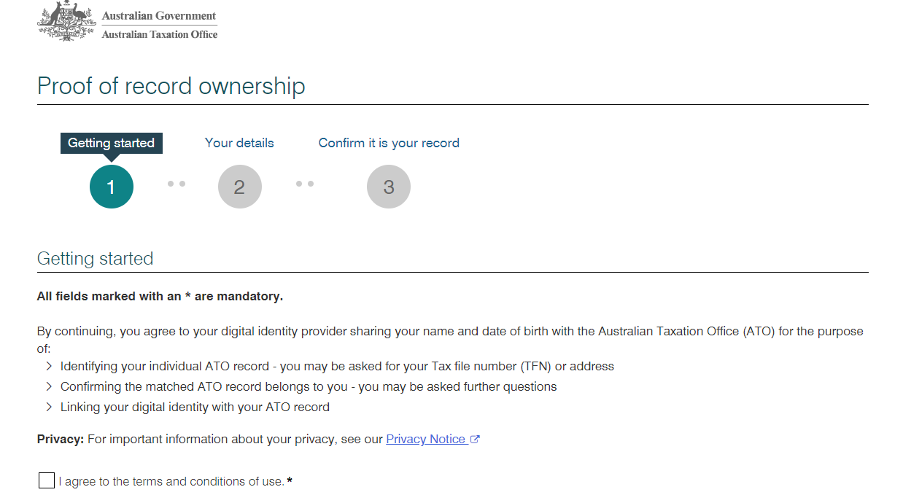

9. When the above steps have been completed successfully, the webpage will automatically redirect you to the “Proof of record ownership” page, this is step one in the DIN application process.

10. Agree to the terms and conditions of use and select the “next” button at the bottom of the screen.

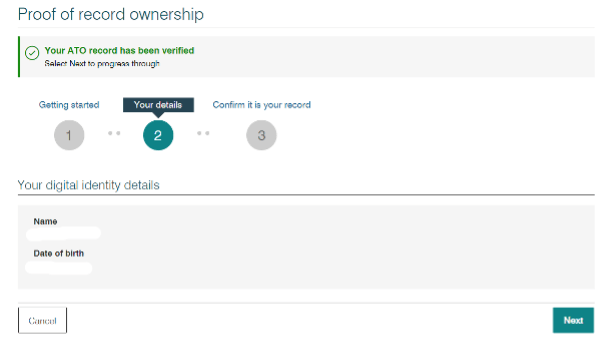

11. If your ID has been successfully verified, you will be taken to step two, “Your details” which will automatically be confirmed by the Australian Taxation Office, as below. If these details are correct, select the “next” button in blue at the bottom of the screen.

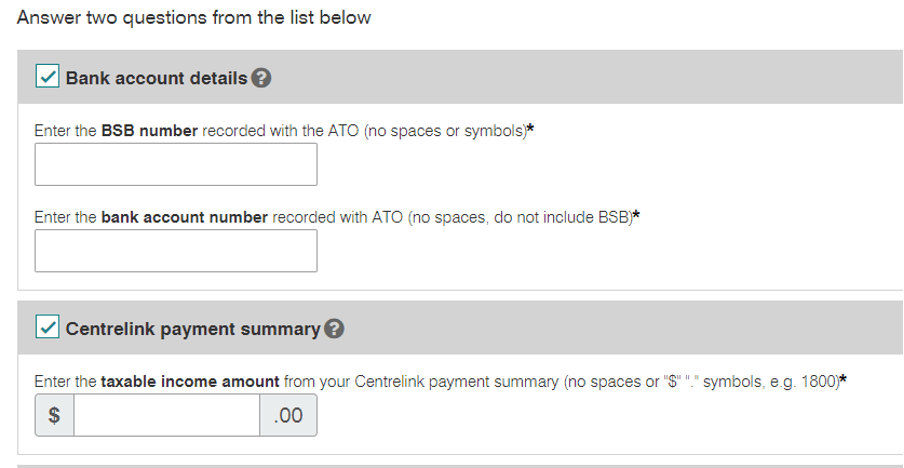

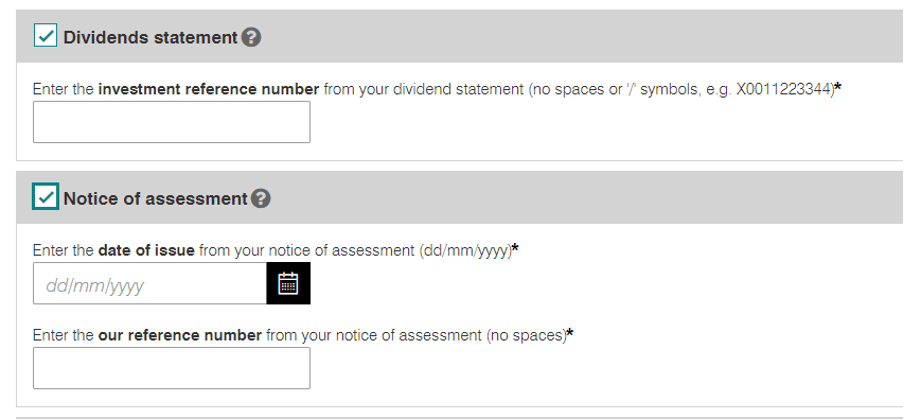

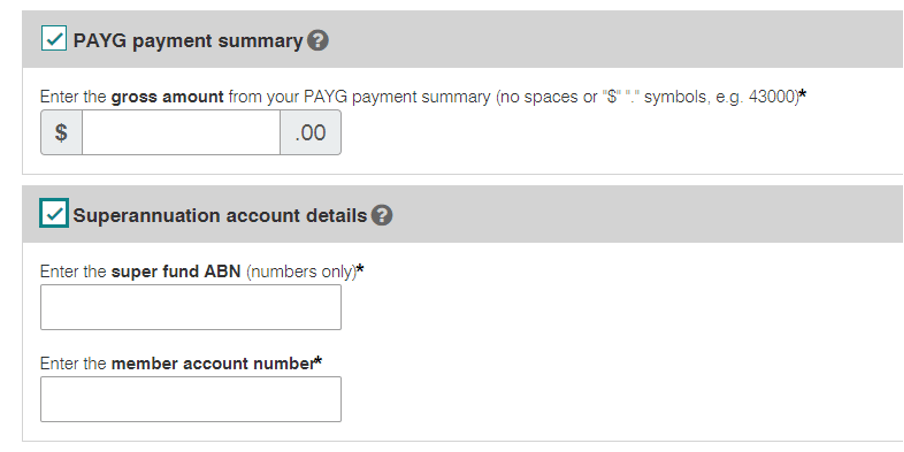

12. You will now need to “Confirm it is your record” at step three of the application process using one of the 6 forms of identification listed at point 4 (c). We recommend using your Notice of assessment and your bank account details as the easiest forms of ID to obtain.

13. Select the box that corresponds to the form of ID you will be using. This will open additional boxes that will need to be completed for each form of ID. You only need to complete two (2) of the six available options. We have displayed each of these below so you are aware of what information you will require.

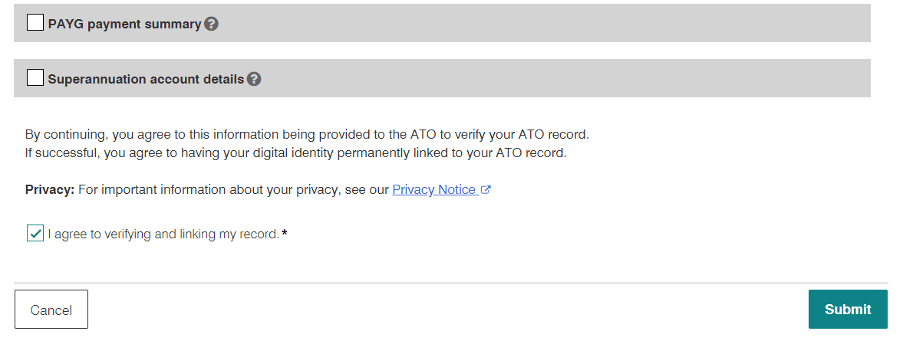

14. After you have completed the required information for your two forms of identity, select the “I agree to verifying and linking my record*” check box and select “submit” at the bottom of the page.

15. If successful you will be taken to the “Proof of record ownership” and the ATO will confirm that your information has been verified. If the details for identification are incorrect, you will be notified and will not proceed to this screen. You will be given three attempts to enter the correct information before you are locked out of the application process for one hour.

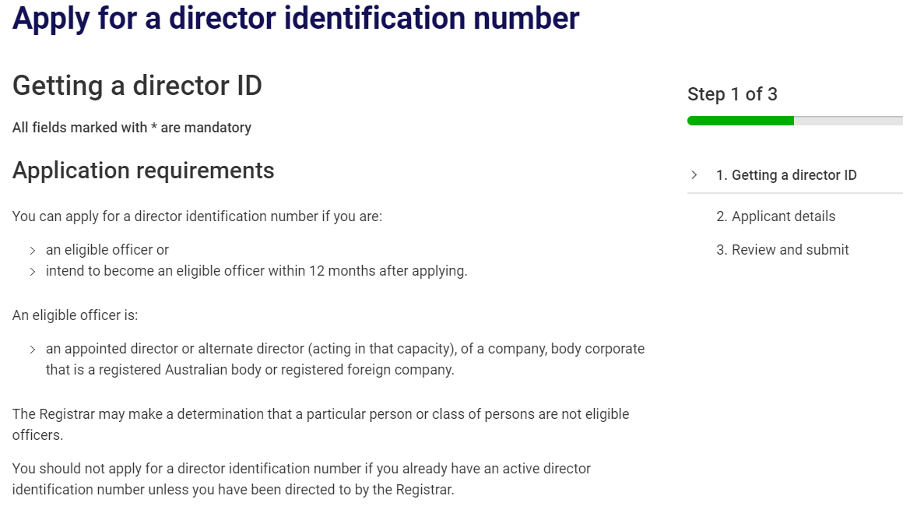

16. Select “continue” and you will be taken to the DIN application form. Here you will need to select the two checkboxes to confirm that you are, or intend to be within the next 12 months, an eligible officer and that you satisfy the criteria to become a director of a company. Select “next” at the bottom of the page once you have ticked the required boxes.

17. Step two will display your details as per the Australian Taxation Office, please review and ensure no changes are required. If not, complete all personal information as required below. When all of the information is complete, select “next” at the bottom of the page.

18. Review the information and declarations you have entered. If all is correct, check the box that reads “I declare that the information given on this form is true and correct”. Then, select “submit” at the bottom of the page.

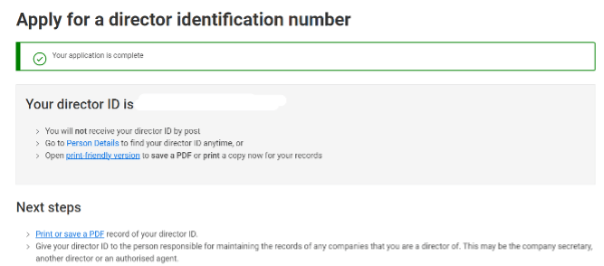

19. You will now receive your Director ID number. This number will not be posted to you. It is your responsibility to retain a copy of this number. Please print, write down and/or save this page for future reference as this number will be required to be provided to ASIC.

20. Now that you have your DIN, you’re required to notify ASIC.

a. If we are your registered office, please provide us with your DIN so we can notify ASIC of your DIN and attach it to all of your corporate entities on your behalf.

b. If we are not your registered office, it is your responsibility to notify ASIC of your DIN and attach it to all of your corporate entities. Monetary fines and potential company deregistration are proposed should the DIN not be provided to ASIC within the relevant time frames.

Need a hand?

As always, please contact our office should you have any queries in regard to the above information.

Need help with your accounting?