What to know about business trademarks & intellectual property

In the ultra-connected world we live in, the Intellectual Property (IP) of businesses is increasingly at risk. With ever-increasing accessibility, trademark, patent, and copyright infringements in general are on the rise. This comes from the work of malicious individuals or organisations, but also through innocent breaches of IP — which can have equally devastating consequences.

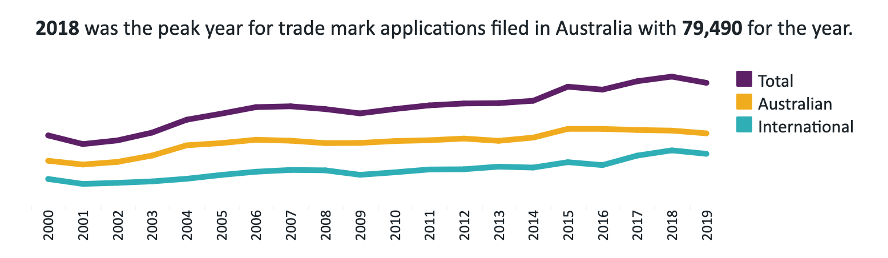

In Australia, interest in protecting ideas through IP rights is increasing. A 2020 report by IP Australia stated that 75 622 trade mark applications were received in Australia — a figure that has been steadily growing since the year 2000.

In all business models, it’s wise and strategic to protect your IP and your ideas. Trademarking your goods or services may be the best option for you. Below, we’re addressing some commonly asked questions about trademarks to help you make an informed decision on whether they’re right for your business.

Firstly, what is a trademark?

Let’s go back to the beginning. A trademark is used to uniquely identify a product or service and distinguish it from the offerings of competing traders. This can take many forms, including:

• A symbol or a number.

• A letter, phrase, or word (in a particular font).

• A sound (such as a musical jingle).

• A shape, picture, or logo (most commonly trademarked).

• An aspect of product packaging.

By registering a trademark, you have the exclusive right to sell the product or service. You can also authorise others to use and sell it. Additionally, a trademark legally covers you if someone tries to replicate the above aspects of your goods and services — whether they do it on purpose or accidentally.

How do trademarks differ from copyrights, designs, and patents?

Intellectual Property (IP) includes all inventions, literary and artistic works, designs, symbols, names, and images that are used to trade. There are many ways of protecting this. Let’s look at the simple case of a pen:

• A trademark application may be for the name of the pen or the type of packaging used to distinguish it from other pens.

• A patent for the pen might be for a particular type of pen with a new way to store its ink.

• Industrial design protection may be sought for the pen’s new type of grip.

A copyright application? That’s different again… This is sought to protect the IP of published or performed material. A copyright grants “the exclusive right to print, publish, perform, film, or record literary, artistic, or musical material or to authorize others to do so.”

How long does a trademark last?

Unlike what many people assume, a trademark does not apply for life. It must be renewed every 10 years to retain the exclusive rights to sell the product or service in question.

A trademark registration can be renewed up to 12 months before the renewal date is due and no longer than six months after (in the latter case, extra fees will apply). Before renewing, you must demonstrate that you have actively used the trademark. If you can’t, the exclusive rights to use it may be rescinded by the Australian government.

Do businesses need trademarks by law?

No, there is no requirement for a business to register any trademarks. However, if you want to protect the unique aspects of your business’s goods and services, you should consider trademarks.

For instance, say you have a registered business name and also registered the domain name of a product. Simply registering does not prevent another business from using very similar details as you for a competing (or identical) product, logo, or service. To prevent this and take legal action if it occurs, you’d need to trademark it in advance.

What’s the difference between registered & unregistered trademarks?

An unregistered trademark is free to use but with restrictions. For example, if someone has registered the same trademark, they can take legal action against you. Using the ® trademark symbol in this instance is an offence, but you can use TM to designate an unregistered trademark.

With a registered trademark, you’re legally allowed to use the ® symbol and nobody else is allowed to use the same trademark. If they do, you can pursue legal action against them. A registered trademark will provide you with more legal protection.

Are trademarks internationally binding?

No; any trademark registered in Australia covers only Australia. For international recognition, you can apply for an international trademark (as long as nobody has registered the trade mark that you want in another country). This will protect you from overseas businesses using the names or other features of your goods and services.

Conversely, if you registered your trademark overseas, but not in Australia, you’re able to use ® to designate this, as long as you state the country of registration near the symbol.

How do I apply for a trademark in Australia?

You can apply online through IP Australia. Detailed steps can be found here. As a quick guide, here are some points to note:

• Applications take around 3 – 4 months to assess.

• There is a cost to applying which will be either $250 or $330 depending on how you proceed with your application.

• Mistakes in applications for trademarks are common. If you make a mistake and need to restart your application after it’s been lodged, any fees you’ve paid will not be reimbursed.

If your application meets all of the requirements, it will be registered. You will receive a written notification and it will appear in the Australian Trademark Search Database.

A case study: the Ugg Boots trademark story.

For Australians, there should be no greater warning about the dangers of not trademarking a product than the story of Ugg Boots. These sheepskin shoes and boots have been made for decades by a family-run business called Luda Production, and we affectionately know them as “Ugg Boots.” However, the trademark for Ugg Boots is held by the American sheepskin company Deckers Outdoor Corporation, which they’ve registered in over 130 countries…

Consequently, the company challenged the use of the name by Luda Production and any other companies around the world using it. This happened even though the name was used in Australia for decades before the trademark application was lodged! This led to court action with major headaches (not to mention costs) that could have been avoided if Luda Production had initially registered Ugg Boots as a trademark.

So, the lesson to all Australian businesses is to register trademarks that protect the unique characteristics (including the names) of their goods and services — before another company does.

Need a hand?

As always, please contact our office should you have any queries regarding the above information. We’re always happy to help.

Need help with your accounting?